Dear Lazies,

Welcome to this month’s issue — now with 100% more money talk.

This time, we’re diving into all things women and finances. Because let’s be real: money affects everything, from our independence to our relationships — and yet, it’s still one of the hardest things to talk about.

So let’s break this silence. Inside this issue, you’ll find:

Honest takes on managing money in a couple (tricky but doable)

A quiz to take with your partner — and a teaser of our upcoming pod episode!

Curated list of our financial recommendations (which are not just ‘stop drinking overpriced coffee’, we promise)

Whether you’re a budgeting pro or just starting to figure things out, we’ve got something for you. Let’s make money convos less awkward — and more natural.

This issue features illustrations from Lou Kiss

Your Lazies

Lazy Harshita — The big scary F-word

Girl Math — an internet meme that refers to the rationalisations young women use to justify indulgent or irresponsible spending habits, often in a humorous or self-deprecating way

Sounds like just another silly meme, right? A harmless trend floating around on your Reels and Stories. But the impact?

Let’s dive into a topic that most women are either clueless about — or love pretending they are (because “math is hard”): FINANCES. The big scary F-word we like to dodge until tax season slaps us in the face. Or until we’re staring at our bank account after a midnight online shopping spree like, “Wait, who spent all my money?”

“Why would they pretend to be clueless?”

One word: Confidence. Or well, lack of it. Turns out, we women aren’t actually bad with money, we’re just scared of sounding wrong.

There’s this super interesting (read: painfully relatable) 2021 study by the Global Financial Literacy Excellence Center. It found that women were way more likely to pick “I don’t know” when asked a finance question even when they did know the answer. And guess what? When that “I don’t know” option was removed, many of them actually got it right.

We know stuff. We’re just too polite, too unsure, or too conditioned to raise our hand and say it out loud. The problem isn’t that we don’t understand finances. It’s that we’ve been trained to second-guess ourselves even when our brain (and our savings account) knows better.

“But why would women lack confidence? Isn’t finance taught equally to everyone in school? Isn’t it kinda on women for not showing interest?”

We’ve never heard that one before. Look, it wouldn’t be that deep if a small group of women just woke up one day and collectively said,

“You know what? Stocks are boring. We’re good with vibes and vision boards.”

But that’s not what’s happening. Across the globe, women are scoring consistently lower on financial literacy tests than men. According to a 2020 study by the OECD, men outperform women by an average of 4 points out of 100 in these tests. Out of the 16 countries they studied, guess how many had women outscoring men? Zero.

This is a systemic, social and cultural cocktail that’s been served to us in pretty glasses for generations. And we’ve been sipping it like it’s normal.

Leaving the facts aside for a second — this whole gap isn’t just some coincidence. It’s rooted in the long, exhausting history of how privileges have been split (read: hoarded) between men and women. Women couldn’t even open their own bank accounts until 1958 in Germany, 1965 in France and as late as 1975 in Spain. Forget investing, many weren’t even legally allowed to hold their own money. Add to that the generations of women pushed out of the workforce, sidelined in schools and boxed into homemaker roles and boom! Welcome to the financial literacy gap we’re still unpacking today.

But things have changed, right? Women are working, earning, breaking glass ceilings and obviously, they don’t need to depend on their partners for finances anymore… right? If only it were that simple.

Let’s talk about the motherhood penalty. A silent tax women pay the moment they’re seen as potential baby-makers. And just when you think that’s bad enough, outdated gender norms come marching in with something called the care gap. Basically, data shows that working women still spend a huge chunk of their lives caring for children, aging parents and let’s be honest, everyone else’s emotional baggage too. More time spent caregiving means less time for learning about money, growing their income or brushing up on finance basics. So, they end up being less financially literate, not because they’re not capable, but because they’re too busy doing everything else. And the price for this imbalance? Women are a shocking 80% more likely than men to retire in poverty. It’s lack of time, support, and “systemic fairness”.

So, what do we do now? How do we escape this mess?

First off, stop asking ChatGPT to explain your finances like you’re five years old — and if you do, don’t just stop there. The financial literacy gender gap isn’t a problem with a magic fix. Start by bridging the gaps in your own financial knowledge. Get your budget tight, build an emergency fund and start saving for retirement like it actually matters (spoiler: it does). Go to webinars, hit up meetups, read blogs, listen to podcasts. And talk about money. Yeah, I know, it’s taboo, but the more we whisper, the more we trip into bad money habits. Chatting openly with friends or colleagues about finances helps you spot unfairness and get brave enough to ask for that raise, learn to invest, or crush any other money goal you’ve got.

On a bigger scale, financial literacy needs a glow-up starting from when girls are little — parents and teachers, I’m looking at you. Studies, like one from Thailand, show that the smaller the wage and wealth gaps, the better women’s financial skills. We have to speak up for policies like equal pay, paid parental leave, affordable childcare and better financial education for everyone. And above all, don’t let anyone make you feel powerless about your money. We deserve an equal shot at financial success, and together, we can make that happen.

Lazy Aleli — Talking about Relationships and Money

When I started dating in high school, my aunt told me that I should always have money for cab fare in case the date doesn't go well.

This advice assumed, of course, that the person I was going out with would pay for my meal. It didn't leave space for the possibility that he'd prefer to split the bill. Or that I would.

And that's as far as it went in terms of the advice I got from my family regarding relationships and money. Have money just in case. A break-glass-in-case-of-emergency kind of thing.

While this advice is reflective of the values of my semi-conservative family in a largely Catholic country like the Philippines, I don't think this is a unique experience. A lot of people find conversations about money uncomfortable, or even impolite, so they avoid having them. This discomfort results in a gap in people's knowledge of their personal finances, and much more in knowing how to handle the topic of money when relationships come into play.

So, let’s hash it out on the upcoming episode of The Lazy Women Podcast! Lazies Aleli and Selin (aka LW’s resident finance girl) talked to financial analyst Tinka Herrera-Dan about discussing and planning finances in a relationship.

And as a little teaser, here’s a copy of the money quiz that Tinka gives her clients. You can use this to determine your own attitudes about money, or maybe start a conversation with your partner. Give it a go, and definitely tune in to the podcast to learn more. <3

How do you feel about the following statements?

(Strongly agree, Agree, Neutral, Disagree, Strongly Disagree)

I am comfortable talking about money with my partner

I need to have a budget and I stick to it

Money should be enjoyed in the present

I don't worry much about the future

We should always lend money to family/friends in need

My spouse is too stingy

Household expenses should be split equally between me and my partner

Whoever makes more money should have more of a say in household decisions

Do you talk about money with your partner?

Lazy Julie — Split the Bills, Split the Feelings?

Lately I’ve been thinking a lot about the fact that so many human relationships feel transactional to me. I hate explaining it with the ‘it’s just capitalism’ take, alright, but it is…

Whilst I’m all for finances trackers (as a Notion enthusiast), I cannot help but find the existence of special apps to supervise your finances as a couple baffling. Mixing feelings (love, I guess???) with money feels wild. It’s like turning something warm and human into a spreadsheet with two signatures at the bottom.

Maybe it’s my Eastern European upbringing, but I was raised to believe that generosity is a virtue. It ties deeply to my — archaic in the West, I admit — views on finances in a couple. My husband’s money? Our money. My money? Mine. My friend’s grandma’s advice, which she conspiratorially shared with me before I left for the big city, was: Always take your man’s money and keep it with you. Never hesitate to ask him for it. It’s the better way.

That’s the unspoken rule — and it works in friendships, too. I’m not keeping score when I take a friend out for coffee or pay the bill after dinner. I don’t expect to see my 5 euros back. Generosity builds bonds. It’s a way of showing love, care, and trust. We don’t measure how much of those we’re going to show to our friends, do we? Or is there an app to track the amount of care? (I’d rather have this one, to be honest).

I’m seeing a completely different mindset here in France. Splitting every little thing, tracking expenses in apps, ‘settling’ after each dinner. It’s a mindset of precision, of balancing accounts, and it does make relationships feel… transactional. Like we’re all just tiny banks, issuing loans and expecting repayments — and God forbid you don’t transfer me 2.5 euros for that pain au chocolat.

Of course, I get that money is a touchy topic. But when it becomes the main topic — when your love life starts to feel like a joint venture, and your friendships like business deals — it sucks the warmth out of it all. I’m not saying everyone should think like me, but I do think we need to reflect on why we treat generosity as an exception rather than the norm. Why is not expecting payback seen as naive? Why are we so scared of being taken advantage of, even by those closest to us?

Maybe it’s time to challenge this idea that fairness means carefully calculated equality. Sometimes, being fair means being generous.

Our articles on the topic of finances — must read!

Our May digest of the freshest pieces:

Thirty going on thirteen: how British drinking culture made me rediscover my younger self by Lazy Eve

better joy on her debut EP, being vulnerable and finding her voice, an interview by Lazy Teodora

When diversity troubles the powerful: Hungary and the Budapest pride ban by Lazy María

Pretty privilege, pretty tired: the costs of conforming to beauty standards by Lazy Julie

Want your article to be featured next? We are excited to announce that we are open for website submissions for May and June!

We are particularly looking for pieces that align with the monthly newsletter themes, which are Women & Finances for May and Female Friendships for June but we are generally open to any kind of pieces that suit the Lazy Women tone and style. Currently we are looking for 1000-2000 words personal testimonials, features, narrative essays, cultural criticism, opinions and anything else that you think might fit.

We are accepting submissions on a rolling basis but for the June theme (Female friendships), it would be great if you would send us something by June 18th

At Lazy Women, we believe first and foremost that the personal is political and that our personal experiences are not isolated, but rather reflective of the worlds that have shaped us and can bring us together.

Send us your pitch via hello@lazywomen.com ! We can’t wait to hear your voice 💖

For this issue, we’re happy to share all-things-finance recommendations from our team!

Literature

- The Pink Tax: Dismantling a Financial System Designed to Keep Women

Broke by Janine Rogan

- A Herstory of Economics by Edith Kuiper

- Fortunes of Feminism: From State-Managed Capitalism to Neoliberal

Crisis by Nancy Fraser

- The Unsustainable Truth by David Ko and Richard Busellato

- Double X Economy by Linda Scott

- We Need to Talk About Money by Otegha Uwagba

- The Price of Inequality by Joseph E. Stiglitz

- Stolen by Grace Blakely

Creators that we recommend to educate yourselves on finances:

- Selin and Nat of Rebalancing Act

- Linda Scott of Double X Economy

- Otegha Uwagba

- Iona Bain of Young Money Blog

- Kate Raworth of Doughnut Economics

Pods & Projects

- The Wallet

- Female Invest

Don’t hesitate to share your recs in the comment section below :)

Lazy Partners:

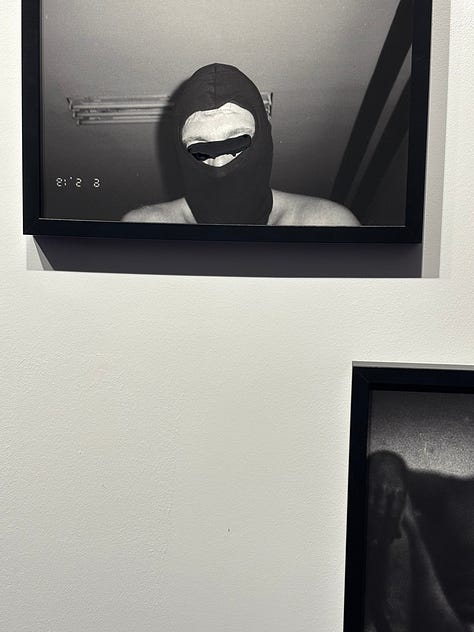

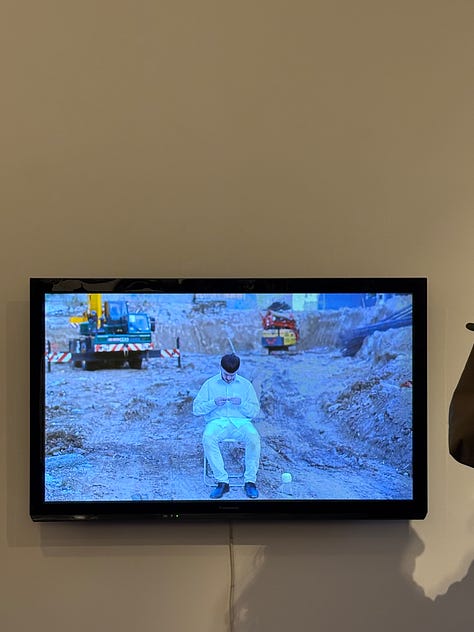

Our friends from the ETC magazine had an exhibition opening in Budapest, which Lazy María had a chance to visit! Here’s her reportage:

ETC is a Ljubljana-based magazine dedicated to exploring current artistic production from the Balkans to the Baltics.

The launch of its 4th issue was celebrated with an art exhibition as a collateral project for the Budapest OFF-Biénnale 2025. The event took place at Liget Gallery, and it was based on this year’s topic: Comfort Zone. Through a very well curated selection taken from the magazine’s pages, transporting to the artists’ safe havens is a one-way ride.

Photos by María Since the beginning, the space is set to make you feel and be intimate with it, as you have to take the shoes off and walk the whole exhibit on a very comfortable purple rug, with Human dog beds (Jelisaveta Rapaić, 2023) waiting for you to lay down, and face your vulnerability. While this happens, Nikola Dimitrivić’s The Favored is playing on a screen in the background. A guy knitting in silence, defying gender roles is listening to the birds, while you keep exploring issues of intimacy, the body and relationships through Mario Zupanov’s Daddy Issues (2023) and Petra Korent’s When I Grow Up, I Will Be Happy (2018-2024). Both artists portraying sexual exploration, inner human connections, queerness and moments of comforting solitude while displaying it in a sincere visual language through photographs, drawings and journals.

Photos by María Here, the “make yourself comfortable” goes beyond the expression. Either you can feel at ease with another person’s interstices of relative and transitional soothingness, or you can experience the darker side of it. Finding solace and safe spaces in modern society is a privilege, but as Hana, Aida and Lara say, the personal is political and seeking that comfort is an act of agency.

The magazine can be purchased online through ETC magazine, or offline in Budapest at ISBN+

We also want to share the launch of the crowdfunding campaign for the Migrant Women Press Fellowship, a six-month program supporting 15 migrant women and women of colour – recent grads, freelancers, and aspiring journalists – to produce original public interest stories from an intersectional perspective.

In an industry dominated by white and privileged voices, this fellowship will empower new talent to challenge misinformation, highlight urgent societal issues, and help diversify the media landscape.The campaign runs from May 3 to July 26. Find more on how to support them here.

Lazy Members (Not so lazy workshops!)

On May 4, Lazy Selin hosted an internal workshop on finances for our members! We had the chance to submit all our (not so) stupid questions on money and investment anonymously and discuss them without the fear of judgment :)

And on May 24, we met for a Growing Through Change workshop hosted by Kate Mas, career fulfilment coach! There, we discussed all-things career, burnout, life transitions and used coaching and journalling techniques to help us self-reflect.

These workshops are one of the perks that our membership offers. Find more information about it here and join the Lazy Women community!

Lazy Paris:

From June, 5 to June, 8 Paris will host the Transeuropa festival, a transnational artistic, cultural and political festival organised by European Alternatives.

This year’s festival is a call to those at the margins – women, LGBTQIA+ communities, the racially oppressed, exiles, the uncertain, the angry, the joyful. Those who refuse to be silenced and erased. Those who combat with fire in their veins and solidarity in their hearts.

Find more information on the programme here and spot Lazy Women on the round table discussion on Saturday, June 7! See you!

P.S. Our newsletter team is fully volunteer-based. We work on every issue throughout the whole month — picking a topic, collecting submissions and illustrations, writing, and editing.

If you like what we do, you can support our work via a paid subscription option on Substack. This subscription also gives you access to our Dear Lazies column, where Zsofi, our editor-in-chief, answers the questions that bother you and provides advice, thoughts, and recommendations!

it was rather difficult to write about money, but that’s the whole point!

loved this one! so much food for thought